31+ reverse mortgage qualification

If youre 62 but your spouse is. Web Heres a look at how to qualify for a reverse mortgage.

Reverse Mortgage Qualifications Eligibility Goodlife

Web Loans backed by the Federal Housing Administration FHA allow retired borrowers to qualify with credit scores as low as 500 and 10 down payments.

. Find Out if a Reverse Mortgage is the Right Tool for Yours. Compare Pros Cons of Reverse Mortgages. Ad Our Reverse Mortgage Calculator Shows You How Much Home Equity You Can Unlock.

The fees and other costs to borrow money this way can be higher than other alternatives like a home equity loan or. Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. Compare Now Find The Lowest Rate.

Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Web A detailed discussion with a reverse mortgage counselor will give you important information to help you decide whether a reverse mortgage loan is right for. Web A reverse mortgage is a loan that needs to be paid back one way or another.

Web The enhancement lowers the minimum qualifying age for homeowners applying for this reverse mortgage product from 60 to 55 years of age in certain states. All borrowers on the homes title must be at least 62 years old. Because conventional loans have tighter.

Get A Free Information Kit. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. For Homeowners Age 61.

Web A reverse mortgage is a type of loan for homeowners aged 62 and older. Web Because of this the reverse mortgage age requirement is 62 or older. Ad Compare the Best Reverse Mortgage Lenders.

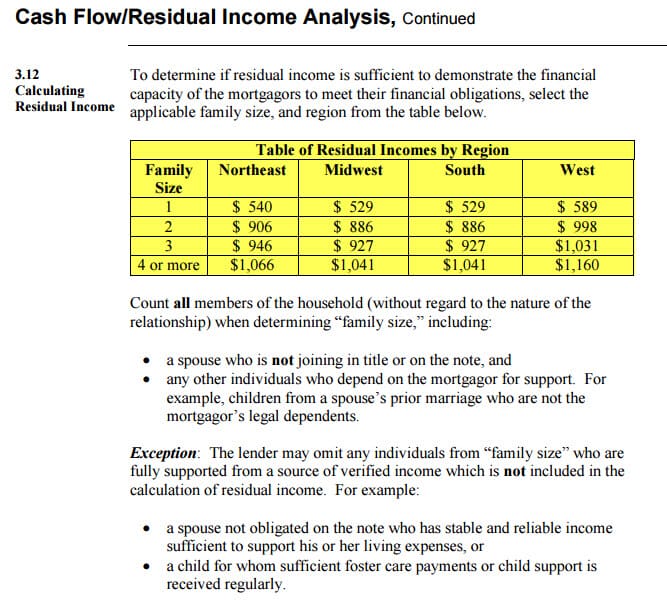

Ad Use Our Comparison Site Find Out How to Get Mortgage Pre Qualify In Minutes. Web Reverse Mortgage Eligibility The basic requirements to qualify for a reverse mortgage loan include. Of Housing and Urban Development HUD oversees the HECM program and it is insured by the Federal.

Get Instantly Matched With Your Ideal Mortgage Lender. Your home must be your principal residence meaning you live there the majority of the year. What makes the HECM different is that its insured by.

If you dont have the money to repay your loan balance and you pass away your. Web This means they tend to have stricter lending requirements though these requirements can vary by lender. Ideally its best to list both parties on the homes title so one person doesnt.

Ad Free Reverse Mortgage Information. Every Retirement is Different. Reverse mortgages have two primary qualification criteriayou must be at least 62.

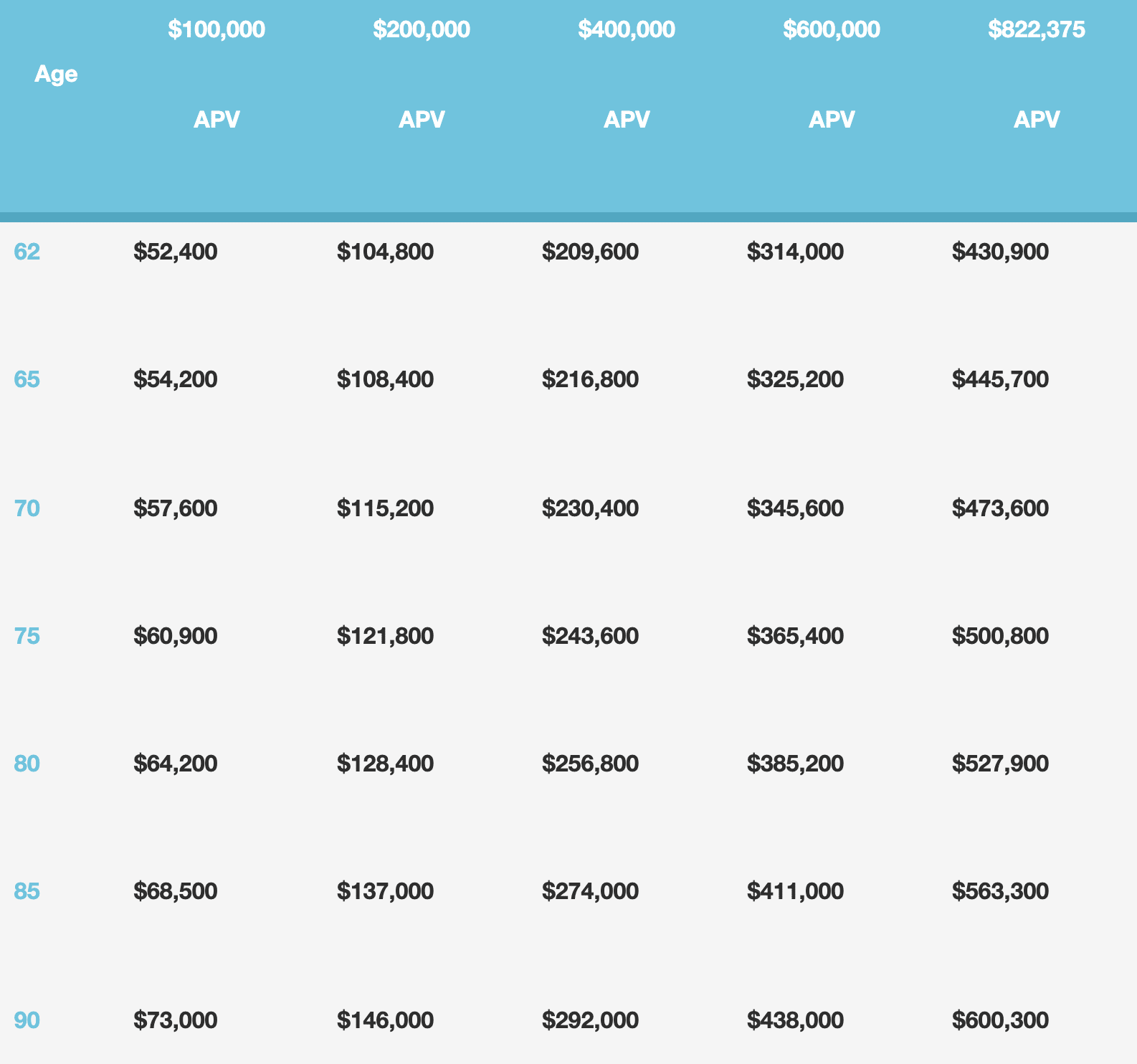

Eligibility for reverse mortgages depends on. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. The older you are the more funds you can receive from a Home Equity Conversion.

Web Reverse mortgage holders and their partner or spouse must be at least 62 years old. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Web Below are some qualifications and requirements as well as other obligations.

Web Aside from age other reverse mortgage requirements include. Web Reverse Mortgage Borrower Eligibility. Certain criteria must be met to.

It lets you convert a portion of your homes equity into cash. Department of Housing and Urban Development HUD requires all prospective reverse mortgage borrowers to complete a HUD-approved counseling session and borrowers must pay an origination fee and an up-front mor See more. You must be at least 62 years old to get a reverse mortgage.

If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. For Homeowners Age 61. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You.

In general to be eligible for a reverse mortgage the youngest borrower on title must be 62 years old or older and have sufficient home equity. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. 1 General requirements age 62 is a homeowner.

HECM borrower requirements Must be 62 or older Must live in the home as your primary residence. Web Like the proprietary reverse mortgage the HECM allows you to borrow against the equity in your home. Web Borrowers must be age 62 or older live in the home as a primary residence and have at least 50 equity in the home.

Web A reverse mortgage can be an expensive way to borrow. The youngest borrower on title must be at least 62 years old live in the.

Reverse Mortgage Guides Mls Reverse Mortgage Powered By Zyng Mortgage

Nahb Report Optimistic About Reverse Mortgages

Reverse Mortgage Requirements For Senior Homeowners Bankrate

:max_bytes(150000):strip_icc()/shutterstock_106623704-5bfc3695c9e77c00519d1585.jpg)

What You Need To Qualify For A Reverse Mortgage

G201504061231506422617 Jpg

Eligibility Requirements For Reverse Mortgage Rmf

Reverse Mortgage Qualifications Eligibility Goodlife

Fwp

Reverse Mortgage Qualifications Eligibility Goodlife

Discover The Latest Age Requirements For Reverse Mortgages In 2023

Reverse Mortgage Calculator How Does It Work And Examples

Reverse Mortgage Property Requirements Updated 2023

Reverse Mortgage Servicing Setting The Record Straight

Reverse Mortgage Age Requirement Minimum Goodlife

2010 May

:max_bytes(150000):strip_icc()/GettyImages-1124801805-281121e5ae6342a394c3e35d08cfb042.jpg)

What You Need To Qualify For A Reverse Mortgage

Who Qualifies For A Reverse Mortgage Youtube